'F' or final is the status you'd hope to see against all your TDS details. 'P' status will be changed to final (F) on verification of payment details submitted by pay and accounts officer (PAO).

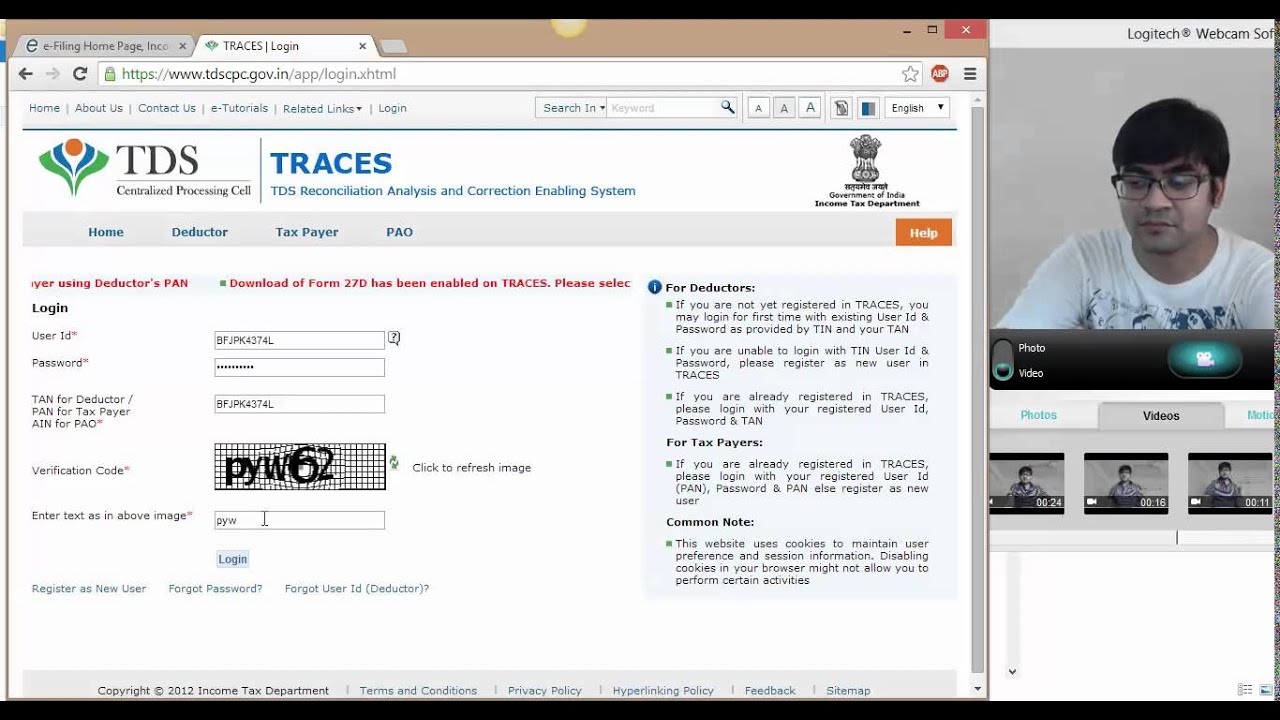

'P' or provisional status means that provisional tax credit is affected only for TDS Statements filed by government deductors. Final credit will be reflected only when payment details in bank match with details of deposit in TDS statement. Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. 'U' or unmatched status means there is a discrepancy in your Form 26AS. If the entries on your Form 26AS are matching, status 'F' is mentioned against status of booking under each of the entries.ĭo you see any entries with a status 'U' or a status 'P'? Or maybe some of the TDS which was deducted from your income does not show up on your Form 26AS. You can also review Form 26AS against your pay slips or bank statement where TDS deductions are mentioned. Similarly you can check TDS details on Form 16A (TDS other than salary) that the bank provided with Form 26AS. You must validate the detail of TDS deducted on your Form 16 (TDS on salary) against the TDS mentioned on Form 26AS. It's important to go through each and every entry on the Form 26AS and validate them. Form 26AS can be viewed by registering with TRACES or through net banking account of tax payers held with banks that have registered with TRACES. It also has details of tax directly paid by you to the government as advance tax or self assessment tax. Deductors usually deduct a TDS of 10 per cent where PAN is available, and if PAN information is not provided a TDS of 20 per cent is deducted.įorm 26AS allows you to view details of all the TDS deducted from your income. Except in the case of your employer, most of the other deductors do not know the tax slab applicable to you. If you work as a freelancer, your client may deduct TDS before making a payment to you. TDS is deducted on salary by your employer and by banks on interest income you earn. Every person who makes a payment may have to deduct TDS to comply with tax rules. Let's first understand what exactly is a Form 26AS. Before the actual process begins for tax filing, one of the important documents to review is your Form 26AS. Soon the government will release tax forms for return filing for financial year 2014-15.

0 kommentar(er)

0 kommentar(er)